The True Cost of Ownership: Why a $300 Pair of Boots is Cheaper Than a $60 Pair

It’s a rainy Tuesday in November. You’re rushing from your car to the office, but a nagging feeling has just become a cold, wet reality. The sole of your $60 “bargain” boots, purchased just ten months ago, has finally given up. A small gap at the toe, which you’d been ignoring for weeks, has become a full-fledged flap. Your sock is soaked. As you squelch your way to your desk, you make a frustrated mental note: “Need to buy new boots. Again.”

The familiar feeling of a “bargain” failing when you need it most.

This scenario is so common it’s almost a rite of passage. We’ve all been there. We see a stylish pair of boots for $60, or a “deal” on a $70 jacket, and we pounce. On top of that, we feel smart, frugal, and savvy by “saving” $240 not buying that ridiculously expensive $300 pair we saw.

But did we?

How could a $300 pair of boots possibly be cheaper than a $60 pair? …But what if we’ve been calculating it all wrong?

The math doesn’t seem to add up. How could a $300 pair of boots possibly be cheaper than a $60 pair? It sounds like a trick, or the kind of “rich people logic” that doesn’t apply to a real-world budget. But what if we’ve been calculating it all wrong? What if our focus on the initial “sticker price” is a trap?

This article will challenge your entire perception of “budget-friendly” by introducing a simple, data-driven formula: the True Cost of Ownership (TCO). We are going to run the numbers on two pairs of boots—our $60 “fast fashion” pair and its $300 “heritage” competitor—over a 10-year period.

The result will shock you. It will prove, with hard numbers, that the $300 boot isn’t just a “better” product; it is a significantly cheaper one. For the budget-conscious skeptic, this isn’t an article about luxury. It’s an article about smart financial planning and achieving massive BIFL savings, a core principle of the Buy It For Life philosophy. Prepare to rethink what “expensive” really means.

What Is True Cost of Ownership? A Formula for Sceptics

“Cost of Ownership” is a term that should be the north star for any budget-conscious person, yet it’s often ignored.

The True Cost of Ownership (TCO) is not the purchase price. It is the total, cumulative cost to buy, use, maintain, and eventually dispose of an item over its entire lifespan.

Most of us make poor purchasing decisions because “Sticker Price Hypnosis” blinds us. Our brains are wired for short-term thinking, so we feel the immediate, sharp “pain” of spending $300 today far more acutely than the dull, chronic, and repeated “pain” of spending $60 every single year.

Retailers know this. They engineer products to hit an appealing, low sticker price, knowing full well that this low price is only possible because the item will not last. It is, in effect, disposable. They are selling you not a product, but the first instalment in a long, expensive subscription of replacements.

To break free from this trap, we need to replace our emotional, short-term “sticker price” gut check with a logical, long-term formula.

The Formula (Data-Driven Anchor)

The TCO Formula:

Annual Cost = (Initial Cost + Total Maintenance Costs) / Total Years of Service

Let’s break down these variables in detail:

- Initial Cost (IC): This is the sticker price. It’s the only thing most people look at, and ironically, it’s often the least important variable in the long run.

- Total Maintenance Costs (TMC): This is the sum of all upkeep costs over the item’s life. For a cheap item, this is $0 because it’s designed to be thrown away. For a quality item, this includes tiny, strategic investments (like shoe polish) and larger, planned repairs (like a resole).

- Total Years of Service (TYS): This is the most critical variable. It is the realistic lifespan of the product. This is where the cheap item completely falls apart (literally and mathematically), and the quality item shines. The entire “cost of ownership” debate hinges on this number.

This formula transforms you from a mere consumer to a strategic asset manager. You’re no longer asking, “How much does this cost to buy?” You’re asking, “How much does this cost to own per year?”

The answer to that question is where we find the savings.

Try Our Interactive Calculator!

Want to see the math for yourself? Use our free “Cost Per Use” calculator to see how much your purchases really cost every time you use them.

The Math: A 10-Year Showdown

Let’s run the numbers. We’ll analyze our two contenders: the $60 “Fast-Fashion Special” and the $300 “Heritage Investment.”

|

Metric |

“Bargain” Boot |

“Heritage” Boot |

|---|---|---|

|

Initial Cost |

$60.00 |

$300.00 |

|

Lifespan |

1 Year (Disposable) |

10+ Years (Repairable) |

|

10-Year Maintenance |

$0.00 |

$150.00 (DIY care + 1 resole) |

|

Replacements in 10 Yrs |

9 (Total 10 pairs) |

0 |

|

Total 10-Year Cost |

$60 x 10 = $600 |

$300 + $150 = $450 |

|

Annual Cost of Ownership |

$60.00 / year |

$45.00 / year |

The Math, Part 1: The Hidden “Subscription” of the $60 Boot

The “Fast-Fashion Special” is a marvel of cost-cutting. Its sole is “cemented” (glued on), making it un-repairable. Its “Genuine Leather” is the lowest grade, designed to crack and peel, not age. The heel is often hollow plastic. It is, by design, disposable.

As the table shows, your $60 purchase isn’t a one-time cost. It’s a $60-a-year subscription for bad boots. Over 10 years, you’ve spent $600 and have nothing but a pile of 10 broken pairs in a landfill to show for it.

The Math, Part 2: How “Goodyear Welt Boots” Create Long-Term Savings

Now let’s analyze the “expensive” $300 boot, which we’ll call the “Heritage Investment.”

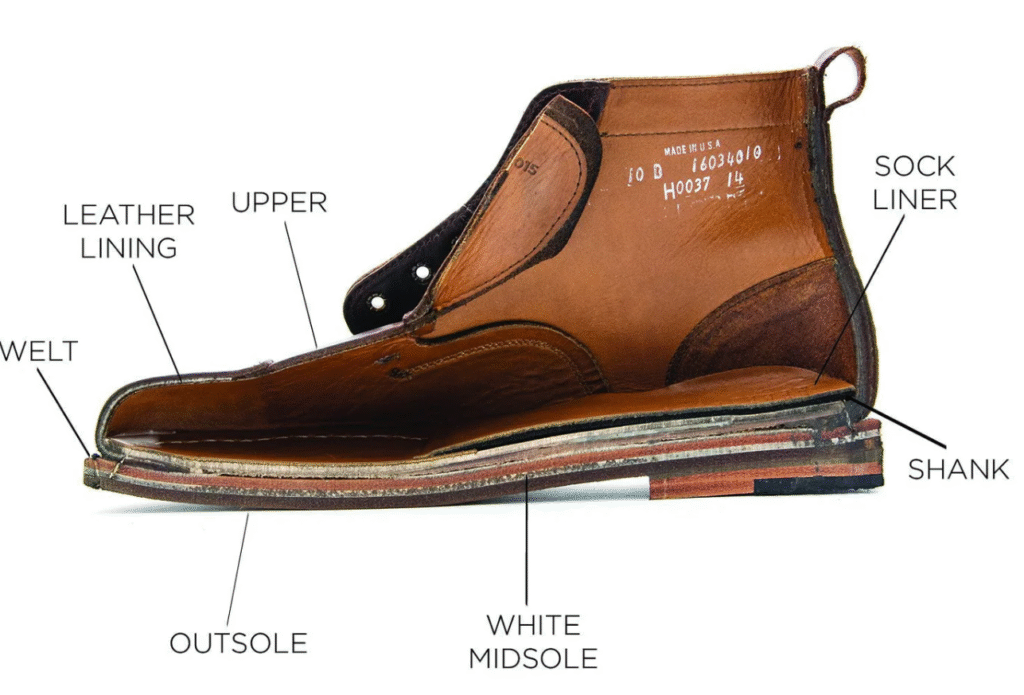

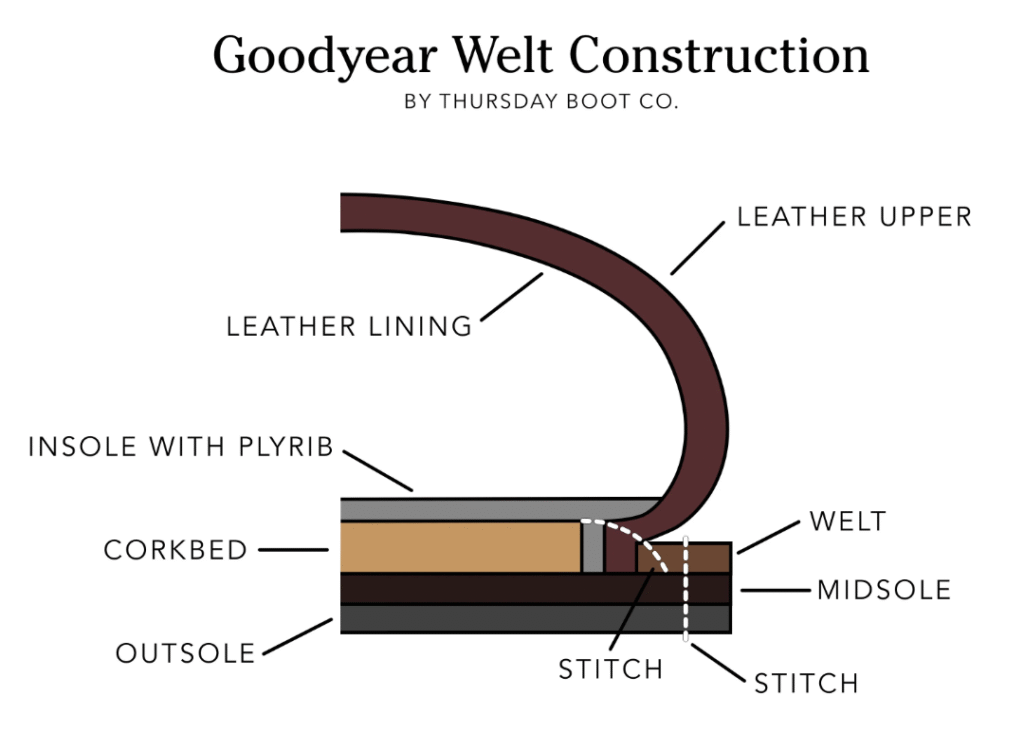

The $300 “Heritage Investment” is a different system entirely. Its Goodyear Welted construction (a stitched-on sole) makes it infinitely repairable. Its Full-Grain Leather upper is the highest quality, designed to mold to your foot and last for decades.At first glance, $300 is a lot of money. It’s a purchase you have to plan for. But what are you actually buying for that $300? You’re buying a different system of manufacturing.

With basic care (around $7/year) and a single resole (around $80 in Year 5), your total cost over 10 years is $450. This isn’t just a cheaper option; it’s a massive 25% savings over the “bargain” boot.

The “Aha!” Moment

The $300 boot is factually, demonstrably, and undeniably cheaper than the $60 boot.

The 10-Year Verdict:

By choosing the “expensive” boot, you save $150 in the first decade alone. In the second decade, your savings multiply as your annual cost drops to just $23/year (for maintenance and resoles).

The BIFL savings from quality-made products are not a myth. They are a mathematical certainty. The person who bought the $300 boot wasn’t being “rich”; they were being frugal. They just did the long-term math.

Why “Are Expensive Products Worth It?” Is About More Than Money

The numbers are clear. But for the skeptic who is still reeling from the $300 sticker price, the “value” of a quality item goes so far beyond the math that it’s almost insulting to only talk about money.

The financial savings are just the entry point. The real question, “are expensive products worth it,” is answered in the daily experience of owning them.

This is best summarized by the “Vimes ‘Boots’ Theory of Socioeconomic Unfairness,” a famous passage from author Terry Pratchett:

“The reason that the rich were so rich, Vimes reasoned, was that they managed to spend less money. Take boots, for example. … A man who could afford $50 had a pair of boots that’d still be keeping his feet dry in 10 years’ time, while a poor man who could only afford cheap boots would have spent $100 on boots in the same time and still have wet feet.”

Terry pratchett

This is the core of it. The person in the cheap boots isn’t just paying more money; they are paying more money for an inferior product and a worse life experience.

Let’s break down the “hidden value” you get for your $45/year.

❤️ 1. Comfort

The $60 boot “breaks,” then disintegrates. The full-grain leather and cork midsole of the $300 boot “breaks in,” molding to your unique foot shape for a custom fit.

♻️ 2. Sustainability & Less Waste

Those 10 pairs of $60 boots are sitting in a landfill. Your one pair of $300 boots is still on your feet. Repair is the ultimate act of sustainable living.

✅ 3. Performance

Remember our friend with the wet sock? The $300 Goodyear welt boots are water-resistant and keep your feet dry. The cheap boot fails when you need it most.

⭐ 4. Aesthetics & Confidence

High-quality leather develops a “patina” and looks better with age. The cheap, “painted” genuine leather just cracks and peels.

How to Spot a “BIFL” Product (and Avoid a “Bargain”)

You’re convinced. You’re ready to stop paying the annual “cheap boot” subscription. How do you identify a true “Buy It For Life” product?

Conclusion: Stop Buying Subscriptions to Bad Products

The “budget-conscious” mindset is a smart one to have. But for decades, we’ve been tricked into applying it incorrectly. We’ve shown how a $60 boot actually costs $600 over a decade, while a $300 boot costs only $450. The “bargain” was the more expensive choice all along.

The true “budget-conscious” mindset isn’t about finding the lowest sticker price. It’s about finding the lowest cost per use, or the lowest cost per year.

Buying a high-quality, repairable item is not an act of “splurging.” It is an act of financial-savvy. It’s an investment, not an expense. You are buying your future self a gift. You are saving your future self money, time, and the sheer frustration of having a wet sock on a cold Tuesday morning.

So before your next purchase, whether it’s boots, a bag, or a winter coat, stop and run the numbers. Don’t just ask, “What’s the price?”

Ask, “What’s the true cost of ownership?”

Your Turn: What’s Your BIFL Story?

What’s one “BIFL” item you bought that has saved you money in the long run? Was there a “cheap” version you used to buy? Share your story in the comments!